Tracking Spending with Apps: Small Taps, Big Clarity

Chosen theme: Tracking Spending with Apps. Turn your phone into a calm money compass with habits, insights, and stories that make budgeting feel human. Join in, share what works, and subscribe for weekly micro-challenges.

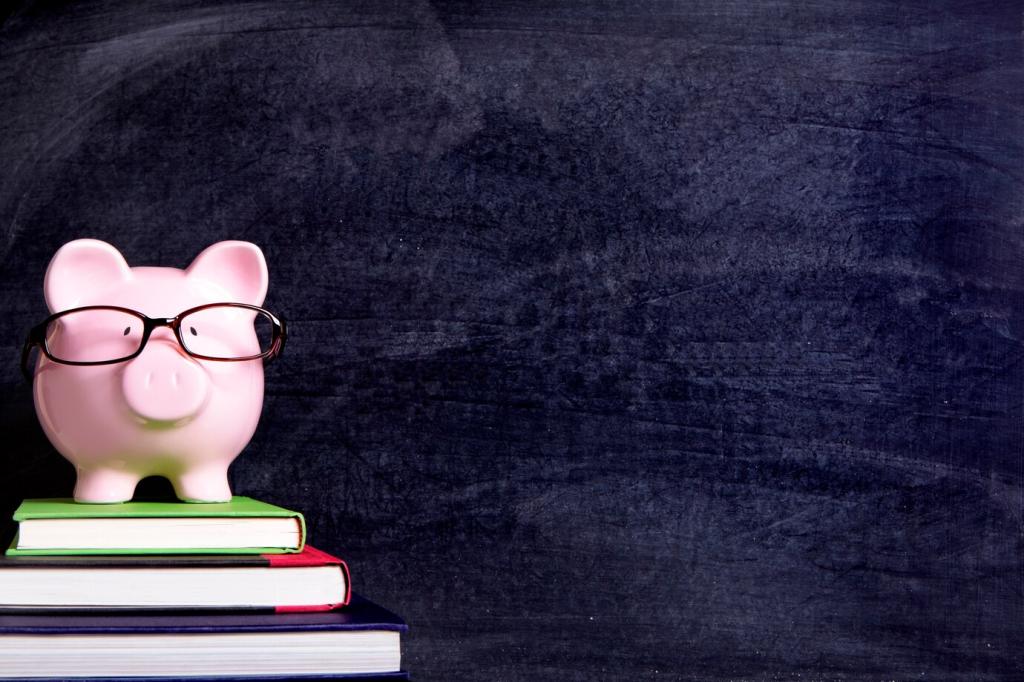

Why App-Based Tracking Works Today

When an app nudges you right after a purchase, you adjust faster. It feels like a friend quietly tapping your shoulder, helping you remember your goals before small splurges quietly pile up.

Why App-Based Tracking Works Today

I once noticed a pattern of tiny delivery fees stacking up. After tagging them in my app for a week, I switched to a pickup routine and saved enough for a weekend day trip.

Choosing the Right Spending App

Look for clean category tagging, fast search, flexible budgets, and bank sync that actually works. If it takes longer than a minute to log a purchase, you will stop using it.

Choosing the Right Spending App

Choose apps that clearly state encryption, let you export your data, and avoid hidden fees. Your money story should be yours to keep, not locked behind a paywall or vague policy.

Setting Categories, Goals, and Alerts

01

Begin with groceries, transport, household, fun, and savings. Add more later if needed. Fewer buckets mean clearer choices and faster tagging, which keeps the habit sustainable when life gets busy.

02

Set specific, realistic monthly caps and a small stretch goal. If you overshoot one week, adjust next week instead of quitting. Progress beats perfection, especially during holidays and travel.

03

Enable threshold reminders at 50% and 80% of each category. Keep notifications friendly, not scolding. A calm nudge after lunch can prevent late-night impulse clicks you will regret tomorrow.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

If weekday lunches run high, prep one extra portion at dinner. If ride costs spike on rainy days, schedule earlier departures. Your app’s heatmaps and tags reveal realistic next steps.

Sort by recurring charges and ask: still useful, seasonal, or forgotten? Cancel two, pause one, and redirect the monthly savings to an emergency cushion or a goal that makes you smile.

Use your app’s projections to time bills just after paydays, and keep a small buffer category. That cushion smooths surprises and replaces stress with quiet confidence at month-end.

Security, Safety, and Sanity

Lock down your app

Enable biometric login, two-factor authentication, and automatic lock. Update the app regularly. Choose a strong passcode that is unique, memorable to you, and never reused anywhere else.

Read the permissions

Only grant what the app needs. Disable unnecessary location access and background refresh if it drains battery. Review connected banks yearly and remove old accounts you no longer use.

Build a boring backup

Export monthly data to a secure cloud folder or encrypted drive. If you ever switch apps, you keep your history—and your confidence that nothing important gets lost in transition.

Staying Motivated with Community and Play

Set streaks for daily check-ins, celebrate category under-runs, and reward yourself with tiny, planned treats. Your app’s badges should feel like high-fives, not pressure or perfection tests.